What Are The Registration Loan Requirements?

A registration loan allows you to get money for emergencies by using your car’s registration, even if you aren’t finished paying off the vehicle. It's often used by people who were initially seeking title loans before realizing they would need to be the complete owner of the vehicle. There are many benefits to a registration loan and title loans with us.

The Benefits Of Registration Loans

Countless benefits exist if you look deep enough about our registration loans AZ from Southwest Title Loans. And it is important you know about them in order to decide if this loan could help you out. Here are the top three benefits you need to know about our registration loans.

1. Fast And Simple Method

When a crisis strikes, you don't have the luxury of time nor the mental capacity to deal with a bucketload of paperwork. While most traditional loans are far too long-winded, you're by no means out of options. Registration loans are quick and don't come with a never-ending criteria list.

You can begin right from home and then just head over to one of our locations to complete the process. We do not even have to inspect your vehicle in order to qualify you. We will just do a credit check and inspect your information to see if you qualify for approval.

2. All Credit Situations Are Welcome

Typically, standard bank loans request a good or even perfect credit score before they even think about offering you a loan. However, that doesn't matter too much when it comes to registration loan requirements. Even though we do check your credit, that doesn’t mean you will be automatically disqualified if your credit isn’t perfect. We welcome credit of all kinds, from perfect to bad!

3. You Keep Your Car While You Repay The Loan

Contrary to popular belief, you are able to keep your vehicle while you repay the loan. The last thing we want to do is take away your only mode of transport during your time of need. So, as long as you stick to the repayment schedule, you can keep using your car as usual.

The Registration Loan Requirements

If you have ever tried to apply for a traditional bank loan, you know how extensive the eligibility criteria can be. Thankfully, that isn't the case with our loans. The registration loan requirements are straightforward. You just need the following items:

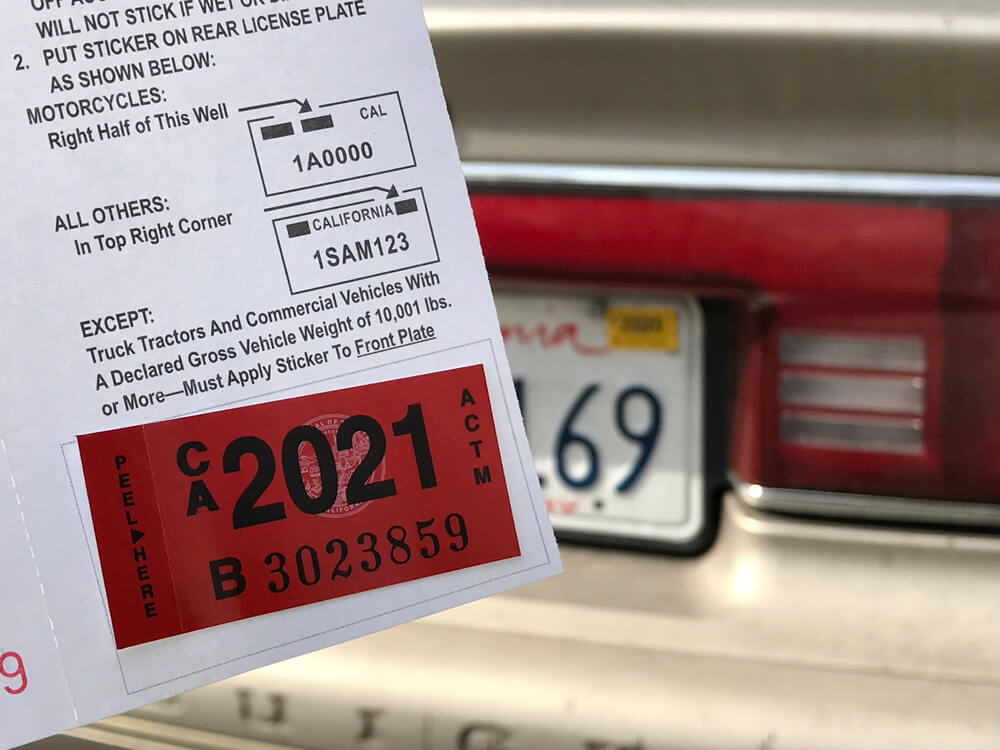

- Your vehicle’s registration

- Your driver's license or another form of state-issued photo identification

- An active checking account in your name

- A valid social security number

Unlike our title loans where we need to inspect your vehicle, we do not have to do that for a registration loan. The one thing to note is, while we can meet you anywhere to complete the title loan process, you must come into the store to complete the registration loan process.

- Complete the form found on this website. The information you provide will only allow us to contact you. We make sure to keep your information confidential.

- Once you submit the form, we will give you a call to answer any questions and set up the meeting for you to come in. We will also go over the required items.

- When you have the items, head over to the nearest registration loan locations in Arizona. We will do a credit check and assess your information to see if we can approve you.

- Once approved, we will go over the loan terms and have you finish the paperwork. When you finish, you can get the money either the same day or the next bank business day.

Submit Your Inquiry Today!

Now you know the registration loan requirements, there is nothing stopping you from getting your hands on one to fund your emergency! However, we always encourage our customers to consider whether they truly need the loan. After all, taking on a new financial obligation isn't something you should take lightly.

If you have an emergency fund or other savings, we recommend thinking about using this to pay for the crisis first. People often find it less stressful to replenish their savings than repay a loan. Similarly, if you have a decent amount of time before you need to pay for it, another financial aid might be better.

On the other hand, if you don't have savings and you need to fund the circumstance as quickly as possible, registration loans are an option. For those of you who fall into the second bracket, feel free to get in touch via your local Southwest Title Loan or complete the simple inquiry form to begin.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.